Here are key considerations and pitfalls to avoid:

1. Calculate Associated Costs

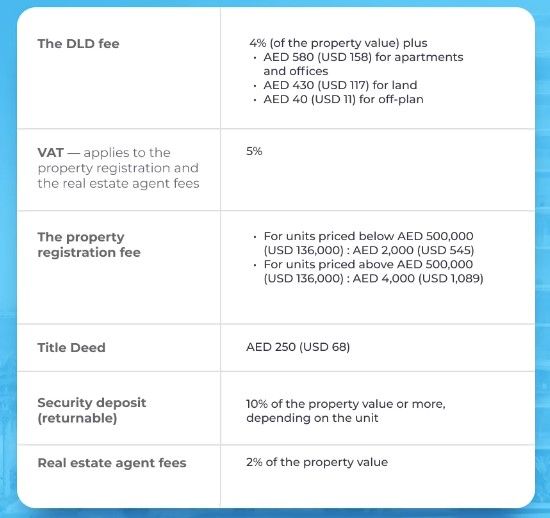

Many investors overlook the additional expenses associated with property purchases in Dubai. These costs include real estate agent fees, government charges, and developer fees, which typically account for about 7% of the property's value. It's essential to factor these expenses into your budget.

For example, if you're buying a completed apartment worth AED 800,000 (USD 218,000), the breakdown of charges may look like this:

- Real Estate Agent Fee: AED 16,000 (2%)

- Dubai Land Department Transfer Fee: AED 40,000 (5%)

- Developer Fees: AED 8,000 (1%)

Thus, the Estimated Total Acquisition Cost (TCA) would amount to AED 854,000 (USD 232,000).

2. Research the Developer

Thoroughly researching the property developer is crucial. Focus on the following aspects:

- Construction Delays: Investigate the developer's history of project delays to gauge when your property will be handed over.

- Portfolio Size: Consider the number of properties the developer has in its portfolio to assess their industry experience.

- Complaints and Disputes: Look for any complaints filed against the company, as it reflects the developer's credibility and problem-solving abilities.

- Specialization: Consider the developer's specialization. If they have previously focused on affordable housing and are now selling luxury properties, assess whether they can deliver the quality expected for upscale projects.

3. Ask Questions

Don't hesitate to ask your real estate agent questions to gain a better understanding of your investment and assess their professionalism. In Dubai, real estate agents are required to have a RERA license, which you can verify on Dubai REST.

Questions to consider include:

- Property Availability

- Operating Costs

- Inclusion of Parking Spaces

- Pet-Friendly Policies

- Additional Questions for Secondary Properties:

- Property Upgrades

- Time on the Market

- Reason for Selling

4. Review Contract Clauses

Thoroughly review all clauses in the purchase agreement to avoid surprises down the road. For off-plan properties, ensure that the payment schedule aligns with the developer's construction stages. Determine the completion date and the legal consequences if the developer fails to meet it.

Some developers may require a specific payment threshold before allowing clients to resell off-plan units. Be aware of minimum selling prices for both off-plan and ready units to avoid selling below the specified value.

5. Inspect for Faults and Defects

Inspecting the property for faults and defects is crucial, and hiring a snagging specialist is recommended. Even if a transaction goes smoothly, undetected issues can lead to costly repairs. For off-plan properties, check their condition before the handover, as developers are responsible for addressing any problems. For secondary properties, agreements between buyers and sellers determine who covers repair costs.

In conclusion, successful property acquisition in Dubai requires careful financial planning, developer research, contract scrutiny, and thorough property inspections. Avoiding these pitfalls will help ensure a profitable and trouble-free real estate investment experience.